A Guide to Strengthening Business Operations with Automated Payment Workflows

In This Post

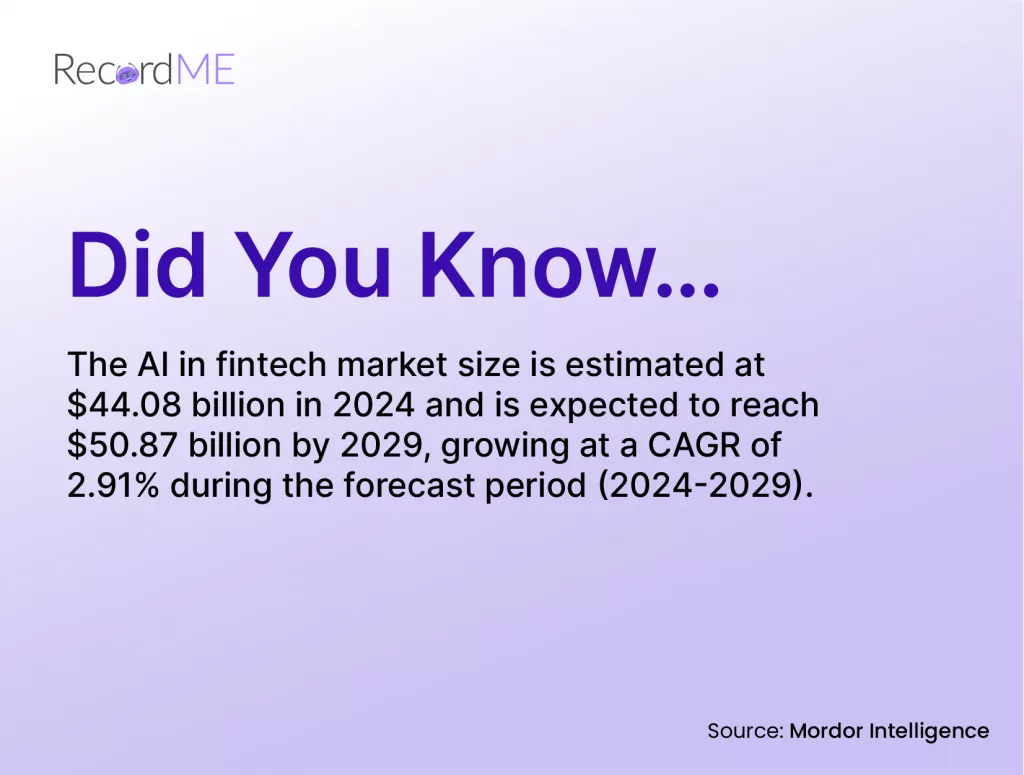

Creating a balance in payment flows is the biggest goal of a company, whether it’s a small-scale, mid-size, or large organisation. Every business wants to move toward a successful future, and it is only possible if they replace conventional financial processing methods with automation technologies. Automated payment workflows help companies streamline financial operations, minimise the need for manual efforts and make enterprises more effective. According to Mordor Intelligence research, remote cashflow processes will reach a market value of $34.18 Billion by 2029. This blog will highlight the payment workflows and how they assist businesses in achieving economic superiority.

Automated Payment Approvals – Preliminary Analysis

Payment approval solutions are used to manage financial operations. It helps businesses reduce inside-company crimes. In this process, apart from the one making those proceedings, a person from the company identifies the finances. In short, it contains the specific regulations for which businesses must pay their receipts. The primary purpose behind these approvals is to decide who will be the person to highlight those rules. Moreover, the criminals hiding in an authentic workplace can be unveiled using automation.

Automated payment approvals are essential to streamline economic processes. It helps in providing efficient services to clients. Companies that want to achieve financial superiority must integrate automation within their organisations. These innovative solutions help simplify finance proceedings. Approximately $10 Trillion in transactions will be done by 2024 on online economic platforms and is expected to increase more in the upcoming years. Therefore, enterprises must integrate digital solutions that will help them achieve unmatched precision.

Reliance on Electronic Payment Approvals

Startups think they can handle their financial operations independently due to low budgets. However, Small-scale businesses are the first ones attacked by the imposters because they do not have strategic plans. To attain business tactics, enterprises should take assistance from virtual solutions. Digital payment workflows are the ultimate services that can enhance efficiencies and reduce employees’ workloads.

Automation has taken the place of conventional tools and solutions. There are a lot of questions that arise in this regard. The first is why automation is a necessity. Another one is when a close relative or a trusted accountant does the payment processing for a company, so is there a need to recheck those finances? The answer is that unintentionally, human beings cause many errors that can be the reason for a business’s downfall. The digital world is relatively complex because firms need advanced solutions to cure modern problems. Therefore, enterprises must execute automated payment workflows to get accurate and instant financial results.

Additionally, automated solutions have machine learning algorithms that help businesses detect the small details that are difficult for human beings to focus on. The approximate market value for these robotic systems in the financial sector is 63%, which is projected to increase in the next few years. Consequently, virtual payment workflows can always be addressed in terms of achieving successful business careers.

Three Stages to Request For Payment Approvals

The most significant three stages that are involved when a client requests payment approval are as follows:

Step 1: Decide Who Should be Involved?

The initial stage in the payment approval process is to decide who will be the action officer. These officials can be the managers, the accountants, or the recordkeepers.

Step 2: How Much Will be Spended?

The second stage involves finances. This process includes the accurate amounts sent to employees separately for validation.

Step 3: Type of Actions Needed

In the third stage, the actions are decided. This process involves the activities that are sparked whenever the system completes a payment or begins with it.

Critical Considerations For Integrating Payment Approval Workflow

When a company inaugurates a payment approval solution, it must focus on critical takeaways before having a client invoice. These significant considerations are as follows:

-

Rechecking of Receipts

In the payment workflows, checking whether the receipt is authentic is necessary. In case of any forged invoice, it is the responsibility of the charge to cancel the order. The action officer should recheck the details and add payments, promotions, and products. This rechecking will save businesses from paying finances twice.

-

Cross Checking of Receipt Dates

The officer should check the dates mentioned over items with those written on receipts. This process will help businesses know they are paying the money on time and ensure that the payments are not given to the client twice.

-

Ratification of Tasks with Managers

The person responsible for the payment workflows must discuss them with the company’s manager. By doing so, the action officer can make a better decision after getting advice from the boss.

-

Identify Supplier Particulars

The most crucial step is to identify whether the supplier is authentic. To check the vendor businesses, compare the client details with those mentioned in the accounts payable system. These preventive measures help enterprises to maintain authentic consumers.

-

Register Reciept’s Deadline

It is necessary to register the receipt’s deadline. By doing so, companies can help themselves when providing additional promotions to the vendor.

-

Plan an Amount

Organising and submitting a payment in the system must be planned before the receipt’s deadline. By doing companies will get timely alerts and save themselves from additional taxes.

Strengthen Payment Approval Workflows With Automation

Automation is the ultimate method that helps enterprises strengthen their financial operations. With the integration of digital solutions, companies can enhance business efficiencies and provide hassle-free services to clients. Moreover, businesses can make better decisions and expand operations internationally.

Perks of Simplified Payments

Through automated solutions, businesses can Simplify Automated Payment Approvals and lower expenditures. These innovative solutions can offer a variety of perks. Some of them are as follows:

-

Make Better Choices

When a company streamlines its payment processes through automation, it also improves problem-solving abilities. Digital payment workflows assist companies in making informed decisions and creating efficient account payable systems. Additionally, automated payment workflows reduced the workloads of accounts management, so they do not have to track down the approvals.

-

Reduce Additional Expenses

Companies can save their finances by submitting pending payments earlier than the deadlines. For instance, if an enterprise delivers the bills on time, it protects itself from late submissions that cause additional taxes.

-

Make Firm Connections

Companies that integrate automated payment workflows can conveniently mark themselves as worthy. There are a lot of businesses that want to link themselves with the enterprises that pay their pending payments on time. Therefore, automation can not only reduce the workload, but it also help in making stronger connections. Moreover, another benefit enterprises achieve after executing virtual solutions is creating transparency with their vendors. Businesses enhance their credibility by communicating with suppliers and providing real-time payments. According to a recent survey, online finance systems achieve a market value of $7.79 Trillion and are expected to increase more annually. Therefore, it is necessary to integrate online services within organisations if companies want to make themselves financially stable.

Automated Payment Workflows with RecordMe

Time is a precious asset for today’s enterprises; if they want to save it, they must execute automated payment workflows. Virtual solutions are not only time-effective, but they also protect the business’s additional expenses on taxes, etc. Organisations feel safe and observe a stark difference in their financial conditions even after utilising these innovative services for a short time. Say goodbye to piles of work. Want to achieve economic superiority or Need an Automated solution for survival? RecordMe is here to help businesses with their superpowers.

Now, businesses can utilise RecordMe to enhance efficiencies and streamline payment workflows. Please don’t hesitate to integrate unique services for growing enterprises beyond their expectations. Companies can create a balance between their cashflows by executing virtual solutions and connecting with our professionals.

Contact us to make informed decisions and better international connections.