A Complete Guide to Automated Payment Processing Services in the Cyber World

In This Post

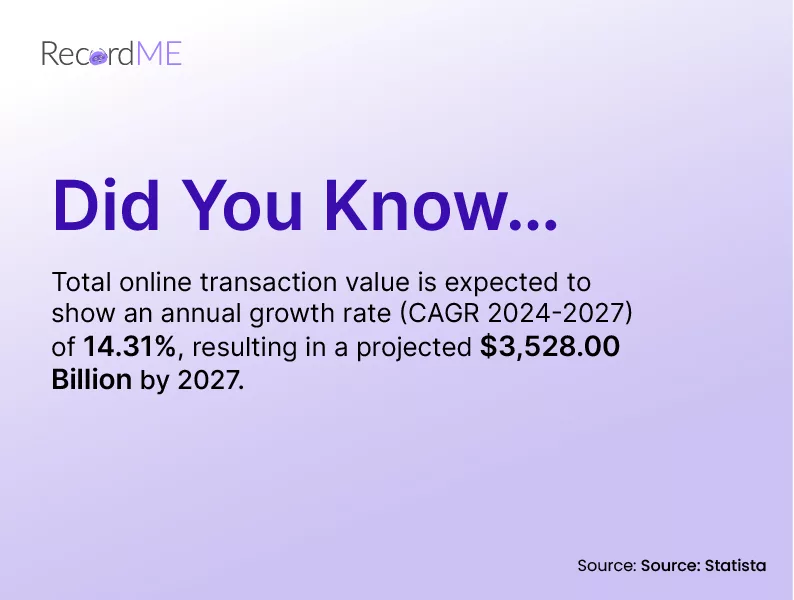

Transaction processes demand a lot of precautions across all industries, whether it’s a remote or onsite business. Ensuring clients have better financial facilities helps enterprises grow more. Companies that want protection against reputational damages and heavy fines must integrate automated payment processing services. Digital solutions assist businesses in improving their infrastructures and enhancing client’s contentment. In 2023, finance approvals reached a market value of 41% and are projected to increase in the upcoming years. This blog will discuss the process involved in payment processing and how it helps enterprises in this digital landscape.

Payment Processing Solutions – A Deep Analysis

Enterprises that provide online services get their payments through automated methods. These digitally provided services take payments through debit or credit cards. To check whether the consumer is authentic, firms demand proper solutions. The ultimate service that will protect businesses and provide hassle-free operations is payment processing solutions. Automated payment processing services make the survival of companies relatively more accessible than the ones who haven’t implemented these solutions yet.

Automation is essential for any business, whether it’s onsite or online. Companies should take advantage of this facility to balance their cash flows. In Europe, payment processors will expand by up to 300% in the upcoming years, which shows their significance in today’s digital world. With the integration of automated fund approvals, enterprises can enhance their business connections and provide seamless experiences to their consumers. Manual payment processing methods were time-intensive and demanded a lot of focus, which was inconvenient for workers. Companies that want to eliminate paper money must make payment processes smooth with automation. Digital solutions are the only way to provide efficient company and client services.

Transaction proceedings seem convenient because of the instant completion, but many factors require attention during finance proceedings. Some of these components are client and payment validity, which greatly matters to enterprises of all sizes. Numerous parties are involved; these are as follows:

- Consumers

- Vendors

- Accounting software

- Online finance application

- The banking sector or any enterprise belonging to financial matters

- Vendor or company bank accounts

Method of Digital Payment Processing

Digital payment processing services are crucial in making accessible financial transactions. It helps in creating a relationship between the vendor and the monetary companies. The Four significant techniques involved in payment processing services are as follows:

- Debit Card

- Credit Card

- Electronic Wallets

- Bank Deposits

The clients use these four techniques to deposit payments in return for online services. Companies turn complex processes into convenient ones by taking assistance from automated services.

Diverse Types of Automated Payment Processing

With the integration of digital solutions, companies can accept client payments through numerous finance processing software. Some of the most important techniques are:

-

ATM Cards

Businesses use credit and debit cards for smooth transactions in this payment process. Clients give ATM card details to firms where they deposit their required money.

-

Digital Wallets

Digital wallets are another method of payment processing services that help smooth money transactions. The users who are account holders sign up for the digital wallets by utilising their credentials. It is projected that by 2026, the market value of online payment processes will increase upto 54%. Therefore, with the integration of automated solutions, companies and clients achieve efficient services that reduce the need to oversee finances.

-

Banking Transaction

Every authentic company has a bank account to receive or pay financial debts. Moreover, they provide all their details to clients, making it feasible for the other party to understand that the connected company is authentic. Bank transfers are mainly used for B2B payment processing and help enterprises by providing them with accurate knowledge.

Core Elements for Online Payment Processing

Online payment processing is crucial for digital enterprises whose earning depends solely on automated services. The most critical factors that must be addressed before selecting automated payment processing services are:

- The chosen service must provide the enterprises with improved consumer services.

- Automated solutions should be scalable and provide clients flexibility regarding financial proceedings.

- The selected tool must give businesses diverse tactics that help them grow.

- Enterprises must have automated solutions that will help them in risk-profiling management.

Benefits of Automated Payment Processing Services

Automated payment processing is essential for authentic businesses that want to complete their financial operations in real time. It offers a variety of benefits to enterprises, which are:

Inaugurate Instant Updates

Numerous reasons cause delays in business payments. The most important thing that must be addressed is the late bill submissions. When companies integrate digital solutions, it helps them get timely alerts so they can make their pending payments on time. Automated payment processing services also protect the agencies from heavy fines and enhance business reputation.

Build Strong Links

Enterprises must build strong links with their business partners because it’s the ultimate method to help them expand their operations internationally. Companies can only provide accessible services to clients if they have integrated automated payment services. By doing so, businesses can achieve economic superiority and improve user’s contentment. With enhanced client satisfaction, companies can generate increased revenues and create trusted consumer relationships.

Create Financial Policies

Businesses with strategic policies can pay pending payments on time. These planned strategies can only be integrated if enterprises take assistance from automated payment processing services. These innovative solutions help businesses maintain their cash flow balance.

Make Convenient Payment Transactions

In manual times, payment transactions were time-consuming and error-prone. They demand focused experts to deal with financial matters, for which companies must pay numerous candidates. Additionally, there were more chances the hired candidate didn’t fulfil the business’s demand. Companies need automated payment processing services to enhance their business efficiencies without onboarding ample candidates. These solutions will complete the tasks in real time and provide enterprises with timely alerts for pending payments that help them grow more than a usual business.

Automated Payment Processing with RecordMe

Nothing is irritating when a business forgets to pay its bills and pending payments on time. They do not have strategic plans to manage their financial matters. For enterprises that are tired of facing the same issues and all the things that went on due to their client’s negligence, RecordMe is here for assistance. It provides companies with timely alerts and machine learning facilities to boost business growth and help them take the initiative towards new projects. Our experts help enterprises with their financial concerns and help them achieve monetary excellence.

Enterprises still missing RecordMe’s effective services within their daily lives must integrate them instantly before encountering any unhappening situation. For more details and guidance, please contact us and avail yourself of a chance for international growth.

Frequently Asked Questions?

Why are Automated Payment Processing Services Necessary for Business Growth?

Enterprises that still use manual processes within organisations never achieve the success companies get when they make automation a part of their lives. Digital payment processing services assist companies in making better connections at both national and international levels.

What are the Significant Reasons Behind Businesses’ Late Payments?

The primary reason that causes payment delays is the lack of strategic planning. These far-reaching arrangements can only be achieved if businesses integrate automated payment processing services within their organisations. This innovative solution provides firms with timely alerts that reduce the high-risk factors regarding delays in bill submission and pending payments.

What are the Perks of Having a Digital Payment Processor?

Digital payment processors offer a variety of perks in the digital landscape, some of them are:

- Automated payment processing services provide real-time completion of tasks.

- It will help enterprises reduce the need to oversee records and buy expensive payment arrangement tools. Additionally, experts are optionally onboarded because all the tasks can be completed automatically.

- Automated payment processors enhance business efficiencies and engage more organic traffic. Moreover, it helps in creating a good brand image in society.