Outsourced Bookkeeping Services: Your Go-To Guide in the Digital Age

In This Post

Conventional ways of bookkeeping were relatively complicated and time-intensive; they demanded proper care and manual efforts that drained all of the worker’s energy. Firms demand automated solutions to overcome uncertain situations in digital departments. Outsourced bookkeeping services assist businesses by reducing employee workloads.

Moreover, companies must incorporate automated bookkeeping solutions within their operations because it’s the ultimate way to challenge competitors.

Outsourced Bookkeeping Services – A Quick Insight

Outsourced bookkeeping is the process of onboarding a third-registered party to manage financial operations. These outsourced parties assist companies with managing their business records and transactions. Authentic agencies can increase business efficiencies and revenues by integrating online bookkeeping solutions. Automated outsourcing services can streamline imbalanced cashflows and can lead businesses to grow exponentially.

Why is Outsourcing Bookkeeping Needed For This Hour?

Outsourced bookkeeping services help companies scale their business operations. It eliminates the burden on companies’ employees, allowing them to focus more on productive activities. Outsourced Companies manage those complex issues that are difficult for businesses to handle and affect their credibility level. Online bookkeeping helps enterprises in their decision-making procedures and improves security measures. According to recent research, the approximate profit from outsourcing is $0.98 Billion. Companies do not have to audit receipts once sent to the candidate, as all the tasks are completed automatically.

Additionally, outsourced bookkeeping services ensure companies have regular updates in their financial records by utilising better technology. Therefore, companies can provide precise details to their shareholders and generate more revenue than usual.

Significance of Bookkeeping Services Online

Decades ago, businesses found complexity whilst completing their daily tasks because they got less profit and had to do a lot of work. The modern world has introduced outsourced bookkeeping solutions to solve this primary concern and achieve financial excellence.

Selecting an authentic recordkeeping service helps businesses reach their targeted goals. Innovative bookkeeping solutions assist in expanding financial operations, especially for the SMEs. According to a survey in 2019, almost 65% of small businesses outsource their tax services. Startups do not know the tactics to manage business operations; therefore, they have difficulty doing so. With the integration of automated bookkeeping services, companies can run robust financial operations and make informed decisions.

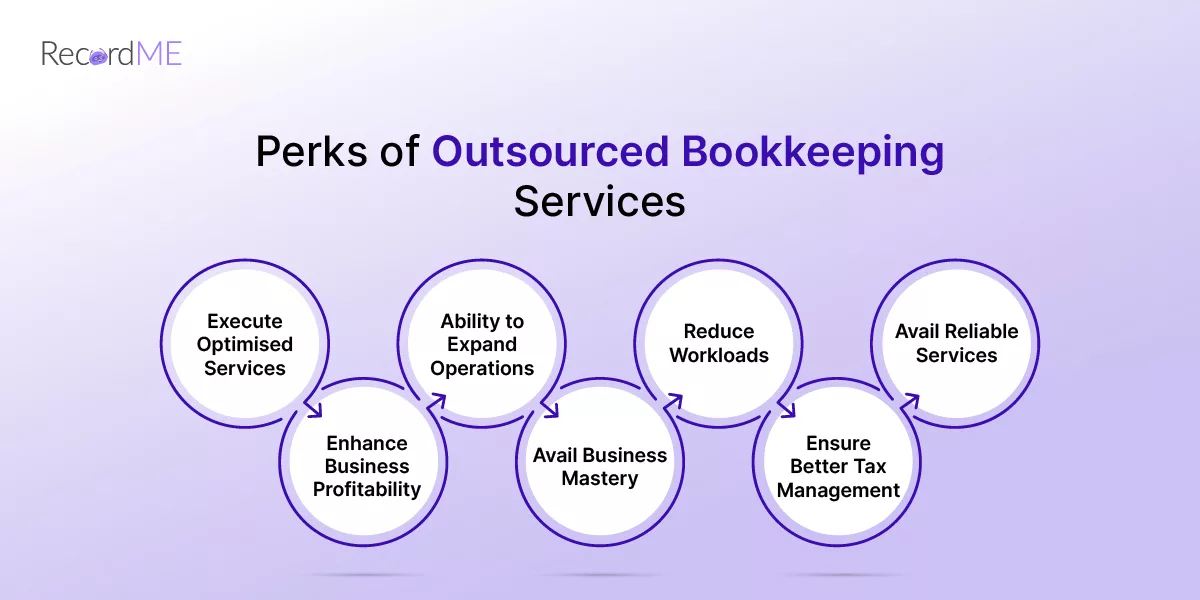

Perks of Outsourced Bookkeeping Services

Recordkeeping can be time-intensive if businesses are not utilising automated outsourcing services. Salary sheets, receivables, and payables consume most of the worker’s time if not done digitally. Companies must have outsourced bookkeeping services to shift businesses from these lengthy financial processes to convenient ones. These solutions offer a variety of perks to authentic companies that are tired of making wrong financial decisions. Some additional benefits are as follows:

-

Execute Optimised Services

Several years back, businesses spent most of their time on recordkeeping operations. With the arrival of virtual bookkeeping services, financial tasks are relatively convenient for companies to accomplish. They can save time and invest in other productive activities to enhance business efficiency.

-

Enhance Business Profitability

Reduced profitability can be risky for businesses at all scales because it affects their worth in society. Outsourced bookkeeping services manage tasks effectively and offer enterprises improved earnings.

-

Ability to Expand Operations

Every company dreams of expanding its business internationally; therefore, firms demand authentic resources to accomplish targeted goals. The ultimate solution that offers businesses scalability and security is outsourced bookkeeping. Through innovative recordkeeping services, companies can empower their businesses at both continent and intercontinental levels.

-

Attain Mastery in Streamlining Operations

Most businesses with fewer resources cannot afford teams of experts; therefore, they onboard unprofessional resources for handling businesses’ critical financial tasks, which becomes the reason for their downfall. Outsourced accounting will provide businesses with an expert team by which they can attain mastery in streamlining their daily operations. Companies can take guidance to update outdated systems, making them more worthy.

-

Reduce Workloads

By getting an outsourced team, businesses can conveniently reduce their workloads. Workers can focus more on the company’s productive goals with less pressure. It is expected that in 2024, the average market value of outsourced bookkeeping and finance operations management services will reach up to $203,8 Billion. Receipt processes, payroll management, and bank reconciliation are all processes that can be completed automatically without any manual effort.

-

Ensure Better Tax Management

Tax management is one of the most significant aspects of a company. If businesses pay taxes on time, they will be protected from heavy fines and imprisonment. Companies must have outsourced bookkeeping services if they want to ensure better tax services and compliance facilities. These solutions will provide businesses with timely payment alerts and make their organisation comply with tax regulations. Therefore, to achieve a smooth taxing experience, companies should take assistance from outsourcing bookkeeping.

-

Avail Reliable Services

A solution businesses can easily rely upon is the best. Outsourced bookkeeping is a reliable service that helps companies streamline their daily financial tasks. It keeps a check on the salary sheets, payrolls, and receipt management. Outsourcing provides hassle-free services to authentic businesses that help them increase their efficiency level.

Considerations Before Choosing an Outsourced Bookkeeper

If a company connects with a fake bookkeeper, it becomes the reason for its downfall. Meanwhile, if the same agency gets involved with an authentic outsourced bookkeeper, they can expand their operations and achieve financial excellence. There are some significant considerations before selecting an outsourced bookkeeper, and these are as follows:

-

Define Business Goals

The first step to identifying an authentic bookkeeper is to list business goals. When companies make records of their primary objectives, they can easily align them with the outsourced agency services.

-

Search For a Provider

After listing the targets, businesses search for an authentic outsourced company and check whether their goals coordinate with the client’s services.

-

Create Transparency With Communication

After selecting the appropriate service provider, businesses must communicate with them through user-friendly channels to create transparency between the two parties.

-

Cost Analysis

In this step, two things are involved:

- The first is outsourcing providers, cost-analysing the companies, and streamlining the finance operations with automation.

- Another thing that the potential company observes in their outsourced partners is that they should be able to control the finances better rather than wasting their time and money.

-

Automatically Perform Tasks

After outsourcing the financial tasks to a third-registered party, businesses can invest their time in other productive activities and enhance business efficiency with less exertion.

How Recordme Came into Vision?

Tired of handling documents daily? Looking for a solution that will save time and expenses? RecordMe is here to help with its advanced services in this challenging situation. Now, businesses can outsource their financial tasks through our professionals. To get diverse benefits, including finance management, receipts processes, and many more businesses can take our assistance. Companies can achieve financial excellence and provide user-friendly services.

Please don’t hesitate to contact us. Our cloud-based services will help enterprises improve their administrative operations and make them worthy at international levels.

Frequently Asked Questions?

Q1: How Secure is My Financial Data When Outsourcing Bookkeeping?

Security is the primary reason for outsourcing. When candidates handle many tasks at once, there are more chances they will fall into the trap of scammers. Businesses must hand over their management operations to a third-registered party to achieve financial excellence. These outsourced bookkeepers can save businesses from all kinds of financial fraud.

Q2: What Types of Businesses Can Benefit From Outsourced Bookkeeping?

Outsourced bookkeeping services offer their services to businesses of all scales. Large, minor, or mid-size companies can use these services to streamline their financial operations.

Q3: How Does the Outsourcing Process Work?

Companies must align their goals with third-party services to select an appropriate outsourcing partner. After that, businesses perform the cost-analysis procedure to balance the cash flows, hand over their management tasks to the externals, and focus on other productive activities.