A Complete Guide to AI-Powered Accounting Services For Small Enterprises

In This Post

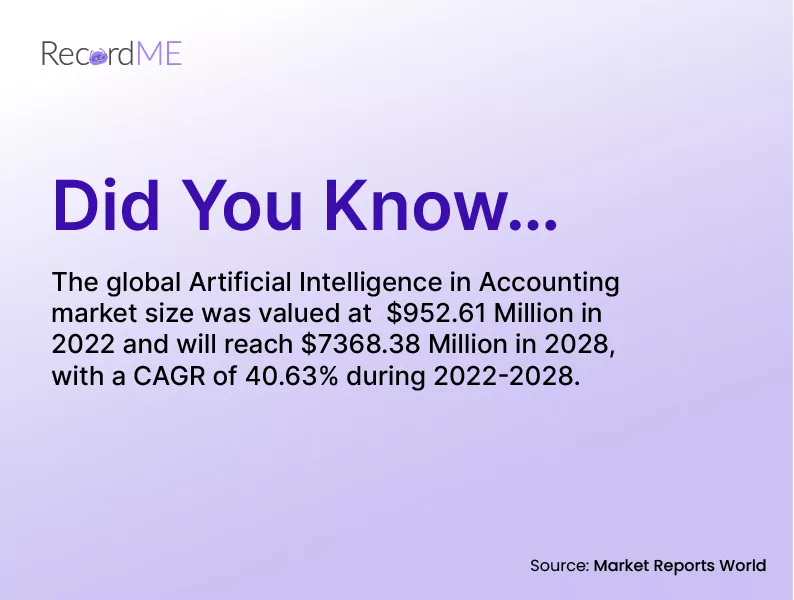

Accounting is a relatively tricky process that needs more attention and time. Finance employees’ slight negligence whilst data entry has severe consequences for the organisation. Conventional accounting method leads to hefty fines, and non compliance with regulations. Small enterprises should utilise AI powered accounting services to complete financial operations in real-time whilst avoiding human errors. In recent years, the $1.17 billion market value of accounts sectors has increased due to the usage of automated solutions. The digital era has revolutionised economic businesses by evolving the financial processes.

Brief Outline of AI-Powered Accounting Services

AI-powered accounting services are used to streamline financial operations and monitor daily management tasks. These solutions are backed by machine learning algorithms that complete operations in real-time without manual effort.

Digital services assist authentic companies in decision-making by offering frictionless solutions to candidates. Companies can rely on automation to complete financial processes in real-time. SMEs can compete with their contenders by using cloud-based technology. Additionally, the machine learning privileges help agencies handle salary sheets, invoices and bank reconciliation processes. Companies that want to promote accurate data must take assistance from digital bookkeeping services.

Difference Between Conventional and Digital Accounting

In old times, economic businesses faced many challenges, making their survival complex among valuable companies. The arrival of digital solutions has solved all these issues and provided remote enterprises with efficient services.

SMEs that face enormous financial threats due to conventional methods are now more secure with AI-powered accounting services. They can save time and enhance business efficiencies with less manual exertion.

How is AI-Powered Accounting Essential for Small Enterprises?

SMEs face massive financial issues due to low budgets. Manual efforts are insufficient to make businesses competitive in today’s fast-paced digital world; startups need AI-powered accounting services to streamline their financial operations. Businesses that use conventional ways to scale their everyday tasks might create a hassle. Providing frictionless and effective services to clients can only be possible if companies start taking assistance from automation.

Advantages of Digital Accounting Services

Artificial intelligence has completely changed how businesses deal with their financial processes. In the past, massive manual efforts were required to fulfill management tasks that exhausted the employees and caused them to lose interest. Delays in the procedures can also cause a reduction in revenue and decreased productivity levels. Businesses should take shelter under automated solutions to achieve considerable worth in society. AI-powered accounting services offer a variety of perks to businesses some of them are:

-

Streamline Daily Operations

With the integration of automated solutions, accounting services can smoothly operate financial management tasks. Businesses should utilise AI-powered accounting services to perform financial processes, including real-time receipt creation, salary sheets, and data acquisition.

-

Improve Business Efficiencies

Small enterprises that struggle to manage their everyday tasks should take assistance from accounting outsourcing services. These innovative solutions help SMEs with additional functions by handling the business’s critical financial tasks. When a third-registered party manages the business operations, companies can focus on other productive activities to enhance efficiency.

-

Enhanced Management Data Processing

With advanced outsourced accounting services, businesses only have a small amount of work. Therefore, they can take insights into other advanced trends and update their systems. Outsourced companies enhance management data processing by using AI-powered accounting services. These solutions help small enterprises in generating improved revenues annually. The market value of receivables is expected to reach $4.76 billion by 2028.

-

Make Informed Decisions

Startups that employ AI-powered accounting services can conveniently make the right decisions. When businesses do not have to enter piles of data and can get accurate details in real time, they can decide things better without stress.

-

Enhanced Cybersecurity Measures

Cybercrimes are the primary reason why businesses need automation within their organisations. Digital criminal attacks are projected to increase by $23.84 billion in 2027. Small enterprises that want to achieve their targeted goals and financial excellence must execute AI-powered accounting services. These innovative solutions can reduce the increasing cybercrimes and make organisations more effective.

-

Improved Client Satisfaction

Client satisfaction is essential for the business’s growth and success. Companies that want to take advantage of this should outsource their financial operations to an authentic third party. Small enterprises can generate more revenue by outsourcing tasks and satisfying multiple clients. Consumer contentment will eventually add value to the business’s brand image.

-

Compliance with Regulations

Compliance with tax regulations has become a dire need for SMEs. With the integration of AI-powered accounting services, enterprises can comply with laws and protect themselves from hefty penalties. When a startup gets the authority’s satisfaction, they can conveniently expand their operations internationally.

-

Perform Analysis

AI-powered accounting services have the additional benefit of predictive analysis, with which they can keep an eye on emerging trends and upgrade their outdated systems to attain business efficiency. Automation can transform SMEs’ previous patterns and provide a forecast analysis for generating improved revenues.

-

Eradicate Manual Mistakes

Conventional methods for bookkeeping were time-intensive and error-prone. Even the most expert accountants can make mistakes. Therefore, to protect organisations from manual errors, startups must take assistance from automation. AI-powered accounting services are the ultimate solution for all the financial complexities companies face because of implementing conventional methods.

-

Reduction in Additional Expenses

When companies do not have automated solutions, they onboard many employees for one task. Moreover, they have to pay for the costly manual mistakes. To protect businesses from additional expenses, SMEs must integrate AI-powered accounting services.

-

Surmount Linguistic and Traditional Barriers

In this data-driven world, SMEs experience diverse challenges regarding linguistics and tradition. Therefore, firms demand AI-powered accounting solutions that interpret various languages. Additionally, they can create transparency between companies and clients. After filling the communication gap, businesses can scale their enterprises to intercontinental levels.

AI-Powered Accounting Solutions: Future of SMEs

AI-powered solutions are the future of SMEs. These digital services protect startups from emerging financial threats. Automation has transformed employees’ lives, taking all their burdens and providing adequate services. Nowadays, workers can complete complex operations with one click. Manual research is not required to make organisational records; all these tasks have been taken by artificial intelligence. The only duty of employees is to make strategic decisions.

How RecordMe Proves to Be a Time-Saver?

RecordMe offers AI-powered accounting services for its clients, with a professional team that helps SMEs with real-time recording facilities. Companies can tailor the solution to their demands and enhance business efficiencies by reducing work pressure. Startups can outsource their financial operations to our dedicated team and generate more revenues. For more details, contact us and expand business operations internationally.

What Makes RecordMe Special?

The features that make RecordMe notable include:

- User-friendly approach

- Real-time data entry

- Error-free

Frequently Asked Questions

What is AI-based Accounting?

AI-based accounting involves cloud-based and machine-learning algorithms by which startups can enhance their financial operations, including

- Invoice processing

- Data recording

- Bank reconciliation

- Salary Sheet Identification

All these processes are included in the management tasks. When an enterprise manages these tasks with AI-powered accounting services, it can easily enhance credibility and create a worthy business.

How Accurate are AI-based Accounting Processes?

AI-powered accounting services are free from manual errors and time-intensiveness, providing companies with precise details that help them generate more revenue.

How Does AI Enhance Efficiency in Accounting Processes?

AI-powered accounting services save business time and complete financial tasks in real-time. With the integration of automated solutions, those tasks that take the entire focus will be done within a few seconds. Employees do not have to read the whole document, as the system fetches the relevant information and makes tasks convenient for the companies.