Small businesses mostly don’t have access to those resources that larger organizations enjoy. i.e., to recover from financial losses. In a challenging economy, a few misunderstandings lead to drastic results specifically in companies that want to gain steady revenues. The CFO daily news article covers that 55% of businesses are incapable of identifying financial errors. Not only this, 70% of experts are not sure about the authenticity of their important information.

From overusing personal credit accounts and falling prey to rising bank fees, accountants face many financial misconceptions in small businesses during their job careers.

Do Small Businesses Need Automated Bookkeeping?

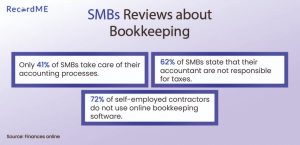

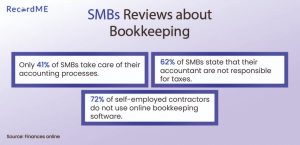

SMBs owners need digital bookkeeping software as it helps them in tracking accounts payable and receivables. This software supports financial institutes by providing a clear picture of the tax filing process and revenue generation. Meanwhile, it streamlines all processes among departments which makes the company image more credible and reliable.

1. Improper Record-Keeping due to not Utilizing Finance Bots

Manual bookkeeping is tedious and requires more employees to keep records. Meanwhile, employees find it hefty to manage bundles of records and put them on shelves in chronological order.

But, Why is This Important?

In a tax audit, employees may call upon to deliver invoices or receipts to prove the credibility of a business expense. But, the proper bookkeeping importance is far beyond the tax ramifications. Is it decided that a company wants to sell it’s business or the buyer would like to request a formal valuation of a business or an external audit of company finances?

In both these cases, invoices and receipts are needed to confirm the financial statement’s accuracy.

Proper digital bookkeeping also discourages employee fraud. Especially when employees understand that they have to submit a purchase receipt, then the usage of business funds will be less for personal expenses.

How to Avoid?

Implement digital bookkeeping solutions like receipt capturing, filing and backup systems by enforcing their proper usage. Finance bots like RecordMe makes it uncomplicated to establish such a technique. That’s why the digital bookkeeping market share is forecasted to increase by $4.25 Billion, by 2023.

2. Inadequate Checks and Balances

It’s easy for any individual to handle all finance matters in small businesses. Of course, it doesn’t make sense to hire and train more staff to fulfill the purpose of check and balance. But, it leads to errors and insufficient checks or balances that cause troubles for the company.

Why This is Important?

If someone other than a business owner or trusted person handles business affairs then the business is vulnerable to fraud. Even if an owner thinks that employees are his family or like a family but still there are chances of fraud. That’s why no one should take care of business affairs other than its owner.

How to Avoid?

Automate check and balance as much as possible in the company. Avoid assigning signing authority to employees at any of the financial statements or business bank accounts. Also, make sure to review the bank statements that include business checks on a monthly basis. For this purpose, businesses can shift to automate bookkeeping apps like RecordMe.

3. Changing Closed Period

Decisions based upon a closed accounting period can lead to taking wrong decisions based on wrong information. If a company changes the information for a tenure in which a tax return is filed, then it should also file an amended tax return. These mistakes are costly but easy to avoid.

Why This is Important?

An accounting period is supposed to be closed when all the data of a specific time tenure has been entered. Liability and bank accounts are reconciled and reports are considered correct. Any minor changes to a closed accounting period require a company to revise the closing process again. Obviously, it’s normal to accidentally enter transactions into a closed period. All it takes is mistakenly keying in the transaction date. Fortunately, there is good news. One easy step at the end of the period can reduce this error.

How to Avoid?

Much automated bookkeeping software allows companies to set closing passwords on financial books. But, still, many owners or accountants don’t use this feature.

If digital bookkeeping software permits setting a closing password, then go for it. It might be the eight-digit date of this ending year like 07122023 for the period ending on December 07-2023. It’s easy to remember for owners or accountants who easily forget the password. If an accountant wants to change any financial transaction in digital bookkeeping software at a closed period then they should get a popup warning. This warning prevents companies from making changes in errors.

4. Skipping Banking Reconciliations

Bank feeds synchronized with digital bookkeeping software allow streamlined bank accounts that match real-time data entry that shows in balance or financial books. Yet, it can’t prevent the need to reconcile credit card or bank statements every month.

Why This Is Important?

When a company reconciles accounts at the end of any month, it validates the information in financial books against any external document like a credit or bank card statement. By doing this, owners or accountants can easily address or detect errors and prevent fraud.

How to Avoid?

Digital bookkeeping helps accountants or owners in making a practice to reconcile credit card and bank statements every month. Put a note in the calendar to make sure that banks are reconciling statements within a few days of receiving statements. If a company is using bank feeds through any digital bookkeeping then reconciliation should take only a few minutes or seconds. That’s why 54% of accountants globally say that technology provides faster service.

How RecordMe can Complete the Whole Scenario?

Digital bookkeeping has virtually eliminated bundles of paper that companies sort into folders and fill cabinets. It’s true that accounting errors create a big problem for any business, that’s why it’s crucial to acquire RecordMe services. It makes sure that reconciling credit cards and bank statements is a piece of cake.