10 Effective Tax Accounting Services For Digital Businesses

In This Post

Tax regulations are complex figures that a non-expert person needs help understanding. These rules are so tricky that businesses can only handle them with a tax compliance resource person. Therefore, accounting platforms must have a trained expert to manage all the tax-related concerns if they want a stable organisation. These professionals will safeguard the enterprises from hefty fines and incarcerations. Government authorities audit the institutes involved with any suspicious activity and file a tax on them. By taking assistance from tax accounting services, businesses eliminate the high-risk factors regarding additional expenses. In 2022, the highest profit gained from tax accounting was nearly $600 million and is expected to increase exponentially in the coming years.

Tax Accounting Services – A Quick Overview

Tax accounting services mainly focus on the daily taxes a company receives and sends to its clients. Authorities provide these solutions to make the clients follow their obligations and eliminate additional fines. In 2019, approximately 65% of owners wanted to utilise tax accounting services within their organisations, and this ratio is increasing with time. Finance automation applies to all small, midsize, or large sectors. These services are just for every individual and organisation; everyone has to pay taxes according to their income and investments.

Categories of Tax Accounting Services

Tax accounting services are further categorised into three:

-

For Authentic Entities

In this category, tax accounting’s focal point is the layman’s regular income, which receives tax whenever deposited in their accounts. The whole process depends on the individual’s funds and transactions. It also considers the payment processing that stop the entities from paying the taxes.

-

For Legal Organisations

Simultaneously, for individuals, tax accounting focuses on the payments that companies deposit and receive. The additional auditing in this category is for the investor’s payments, whether laundered or not. It assists authentic businesses in paying taxes to meet the authorities’ requirements and stay ahead to fight emerging threats.

-

For Tax-Free Businesses

Tax accounting is also essential for the agencies that are exempted from them. For tax-free organisations, these solutions focus on the company’s yearly report to improve their security measures and expand financial operations. By integrating innovative finance services, companies can stay compliant with regulatory requirements and protect themselves against heavy penalties.

Motive Behind Finance Automation

The prime motive behind accounting automation is to keep a check on the client’s finances. This tracking may also result in auditing an individual caught red-handed while laundering money and doing some suspicious activity.

Top 5 Ways to Discover Best Tax Accounting Services

There are a lot of techniques to find tax accounting services. Here, we will discuss the most effective five methods that are necessary to explore these services:

-

Alignment With Business Tax Requirements

The tax accounting process begins with exploring the best accountants to manage company taxes. In the United States, the approximate generated tax profit from 2007 to 2022 was $1.46 Trillion. Therefore, companies must categorise and align the experts with the business’s tax requirements.

-

Identification Process

After selecting the appropriate candidate, businesses check their credentials. Through automated solutions, companies check whether the client is involved in suspicious activity. As the world is moving towards automation, businesses require experts to handle these services. The average rate of candidates onboard for these positions was approximately 1.6 million in 2022. Moreover, the educational background is also detected.

-

Gain an Understanding of Previous Experiences

Organisations should check the previous background of the client, including their academic status, to get a trusted accountant. These identifications will assist the businesses in finding eligible candidates.

-

Auditing

Through automation, businesses can also audit the details of the potential candidates and ensure whether they are authentic or not.

-

Electronic File System

Organisations should also ensure the accountant is familiar with the electronic tax filing system. The world grows exponentially, and so does the technology; therefore, if companies want to get a leading position, they must opt for e-taxing solutions. The candidate’s acquaintance with these automated solutions will assist the company in providing real-time services to clients.

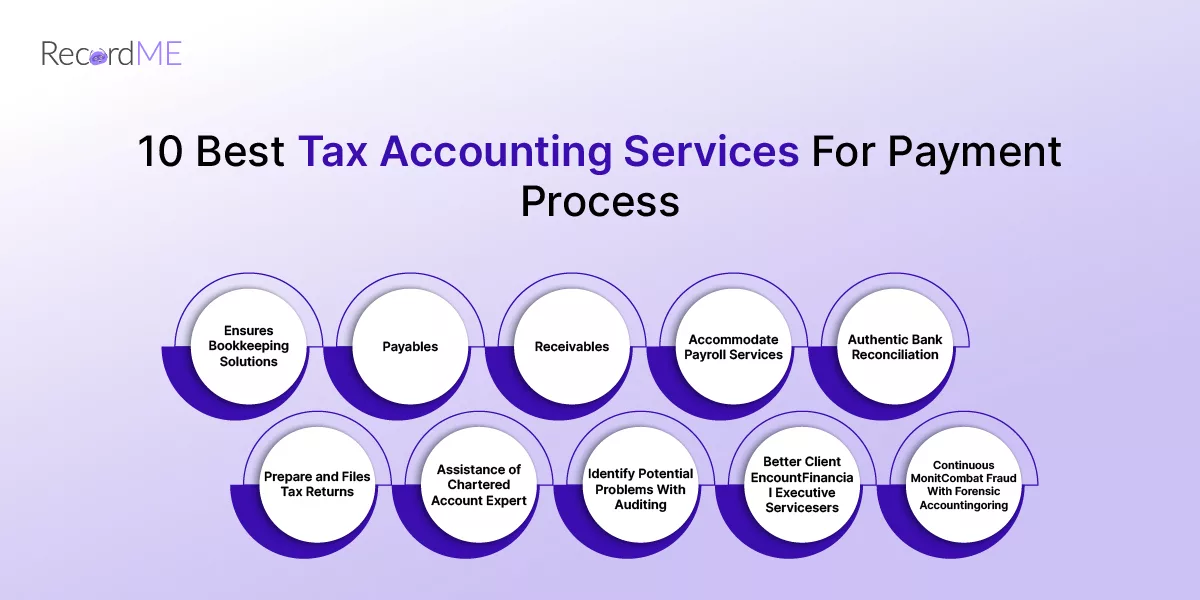

10 Best Tax Accounting Services For Payment Process

Tax accounting services are crucial in scaling business operations and complying with regulations. To accommodate the authentic payment processes for clients, businesses should execute these:

-

Ensures Bookkeeping Solutions

Businesses should utilise bookkeeping solutions to confirm a valuable payment process. Companies use these services to streamline financial processes and record all pending payments. When organisations lack record-keeping solutions, it becomes relatively complex to accommodate their businesses further. Moreover, they will never compete with their contenders.

-

Payables

Tax accounting services enable timely alerts of pending payments. Payables include all the company finances that have either been taken for a loan or getting services from another organisation. By integrating these innovative services, businesses will minimise the risk factors regarding forgotten payments and additional penalties.

-

Receivables

AI-powered accounting services provide businesses with a record of their client payments. Receivables are the finances that the company gives to the candidates. Tax accounting services assist businesses in getting alerts about pending client payments. Organisations send client invoices and wait for their money deposits. When consumers transfer finances, the account is resolved; if they ignore the invoices, they are sent to the outstanding status.

-

Accommodate Payroll Services

Payroll handles the regular income of consumers. It ensures the management of worker earnings to achieve financial excellence. Businesses that want unmatched precision can opt for these services and scale their operations.

-

Authentic Bank Reconciliation

In this process, businesses compare the cash flow with the bank statement to learn whether the transactions are authentic. To maintain the validity of financial operations, enterprises need a reconciliation process that protects them from heavy fines.

-

Prepare and Files Tax Returns

These services enable companies to pay the taxes strategically decided by government agencies. Automated tax accounting services identify whether the client is sending accurate and timely finances for the taxes.

-

Assistance of Chartered Account Expert

Accounting automation also provides the services of a chartered account; therefore, companies must have a CA within their organisations. These professionals ensure the accuracy of economic plans.

-

Identify Potential Problems With Auditing

Businesses can utilise auditing to achieve financial excellence as these services detect significant complexities and improve security systems. Organisations can ensure regulatory compliance by reviewing the backgrounds and finances of clients. Moreover, business owners can also save them from incarceration.

-

Financial Executive Services

Financial executive services are provided within the developing phase of businesses. It helps them expand their operations and achieve worth in society. The expert who manages these financial services contributes significantly to the company’s betterment.

-

Combat Fraud With Forensic Accounting

Financial crimes are increasing with time; businesses are trying to find new services to improve their security measures. Forensic accounting, the services provided by finance automation, are used for these purposes. It detects unprecedented financial attacks and provides an adequate environment for the workers.

How Can RecordMe Assist?

Businesses forget about their payments and, scared of being involved with money laundering, can use RecordMe to assist. These solutions will handle their financial operations and improve security measures. Businesses can get timely alerts and achieve financial excellence with this solution. By integrating these innovative services, companies can grow them exponentially and compete with their contenders. Contact us to learn more about how to make effective organisations.

Feel free to ask RecordMe professionals and get real-time alerts of pending payments.

Frequently Asked Questions

-

What are Tax Accounting Services?

Tax accounting services handle all the issues related to finances. It can be the loans clients have taken from the company or the payables. These solutions check all these pending payments and provide timely alerts that help them achieve financial excellence.

-

What is the Importance of the Approval Process?

Payment approval is vital in making a company effective and scaling its financial operations. These processes assist companies in making informed decisions about pending payments and candidates.

-

What are the Methods of Tax Accounting?

Tax accounting can be done in two ways. The first one informs about the profits and finances using cash flows. The second tax accounting method is accrual, which records agreements using debit and credit cards. This way also deals with the payables and receivables.