Even in this day and age, most accounting firms are resisting the shift to accounting automation, preferring only human accountants. However, avoiding online accounting services can severely limit an organization’s ability to grow and evolve into a significant business. Observations and deep analyses of the market reveal that the key players in these companies have certain reservations about automation technology. Low trust in the capability of technology and job security plays a significant role in this decision.

Yet, technological advancements continue to prove that automation aims to remove the manual burden so that the talent can focus on more critical issues. By 2030, the global market for online accounting software is forecasted to reach $29.8 billion. This growth depends on a compound annual growth rate (CAGR) of 9.2%. Here are some of the frequently asked questions about accounting automation that every decision-maker in a company should check before implementing a bookkeeping solution.

Which Bookkeeping Tasks can be Automated?

Accounting automation is using technology and software to streamline accounting processes and reduce the need for manual input. Broadly stated, the current software technology allows the automation of all repetitive tasks. It follows the principle of rule-based AI accounting. In essence, the system follows a curated rule set to interpret accounting information and draw results from it. Therefore, any accounting work that involves manual repetition can benefit from online accounting software.

Bank Transactions

Considering the high-risk nature of online banking, it falls on the accounting department to ensure that transaction details match the actual cash flow. Manually, such a process can take countless hours, not to mention the human talent cost associated with it. On the other hand, AI bookkeeping services can pull transactional data from different sources and maintain accurate transactional records. Similarly, FATF and similar authorities now enforce stringent bank regulations to curb money laundering and terrorism financing procedures. Accounting automation can ensure timely and correct regulation compliance by automatically categorizing transactions.

Customized Financial Reports

Finance and accounting departments already have a lot on their plate with continuously monitoring accounts and decision-making. As such, curating and generating financial reports can burden the team, negatively impacting their productivity and output. Bookkeeping services can also help automate financial reporting by providing on-demand and up-to-date reports and statements.

Read more on how to make better decisions using accurate and reliable financial statements.

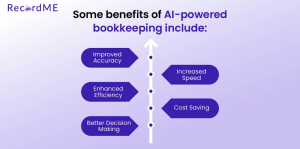

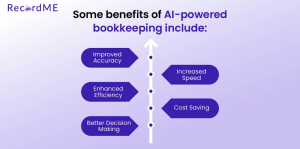

What are the Benefits of AI Accounting?

All businesses, regardless of size or industry, can benefit from accounting automation. Even though some businesses utilize bookkeeping services in some capacity, they are not leveraging their full capability. Smaller companies may benefit from reduced workload and more accurate financial reporting, while larger ones may benefit from enhanced reporting capabilities and improved efficiency. Here are some advantages that companies can expect by deploying a robust accounting automation system:

- Saves Time: According to a Goldman Sachs report, accounting professionals spend as much as 30% of their time only on collecting data about invoices. In contrast, accounting automation eliminates the need to spend hours on data collection and gathering. In the process, saving up to 80% of the time by automating accounts payable (AP).

- Real-Time Monitoring: The biggest problem with traditional accounting is manual data entry. Major business decisions are kept on hold until the accountant completes the data collection process. Accounting automation helps bypass this tedious process by providing insights into the data as soon as it is available.

- Minimizes Errors: Unlike humans, the productivity and efficiency of bookkeeping services remain the same even when stumped with a considerable workload. Thus, increasing the accuracy and integrity of collected data.

How Does Automation Impact Job Security for Accountants?

While there is concern that automation may replace jobs, trends suggest otherwise. A survey revealed that 67% of accountants prefer online accounting software over on-premise solutions. On the same note, businesses that integrated online accounting automation reported at least a 15% boost in their annual revenue. Therefore, the significant impact will be on the job itself rather than the job security of accountants. Online accounting software will transform the roles by reducing the need for manual tasks and freeing up time for accountants to focus on higher-value work such as decision-making and planning.

Will the Solution Integrate with Existing Accounting Software?

Accounting automation software can often integrate with existing accounting software to streamline processes through application programming interfaces (APIs). For example, if a business is already using accounting software like QuickBooks, it can integrate with online accounting software to automate the data entry and processing of receipts and invoices. This means that instead of manually entering data into QuickBooks, the tool automatically extracts the relevant data and creates entries in the accounting software. Integrating accounting automation tools and existing software can help businesses save time and reduce errors, leading to significant cost savings over time.

RecordMe – For Accountants

RecordMe is an accounting automation bot that automatically collects accounting data and adds entries to your preferred accounting software. We achieve state-of-the-art accuracy and efficiency using market-leading OCR technology and artificial intelligence. Automation is a complete transformation, and data collection is not its only challenge. RecordMe goes above and beyond to provide customized monetary reports, including profit & loss reports and cash summaries. Generate reports on the go, monitor transactions and accounts, and make decisions quicker than ever.