Despite the seismic uncertainty in the last few years, large-scale organizations and even small businesses are shifting their focus entirely from short-term gains to long-term stability. This shift has given rise to the mass adoption of technology in all fields. Accounting is not far behind. Even though the global economy is still unstable, some emerging digital accounting software trends have maintained momentum in 2023. As finance professionals and business leaders look ahead to the new fiscal year, here are some digital accounting software trends to watch out for in 2023 – and why it would be wise for leaders to implement these technological trends sooner rather than later.

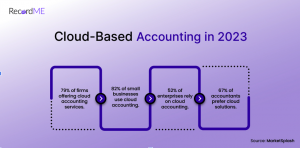

Cloud-Based Accounting

With the increase in remote work and collaboration, cloud-based software has been gaining popularity in recent years. Since this technology allows accountants to collaborate in real-time from anywhere in the world, its significance in the accounting field must be considered. The global market for cloud-based digital accounting software is projected to increase from $3.1 billion in 2020 to $4.8 billion by 2027. This growth depends on a CAGR of 6.2 percent in the defined period. Conventionally, businesses tend to maintain physical servers for storing operational and financial data. However, such a crude approach in the current era can lead to inefficiencies in the form of weak data security and slower data access.

Moreover, it introduces unnecessary friction among teams working on the same project. A lack of a central data repository means that employees have limited access to updated data, resulting in delays across the board. In comparison, cloud-based digital accounting software ensures quick access to real-time data from anywhere in the world.

AI and Automation

Robotic process automation (RPA) has been transforming the accounting industry for several years now, and with the advent of artificial intelligence, this trend will only speed up in 2023. Unlike before, AI has allowed companies to add massive features and attributes to digital accounting software. For instance, intelligent character recognition (ICR) is the by-product of AI, which allows for smoother and more accurate data extraction. Therefore, companies can completely replace manual and repetitive tasks with digital accounting software. Besides saving crucial resources for the company, it also saves time for the accounting professionals, allowing them to spend their time on higher-value tasks, such as decision-making.

Outsourcing Digital Accounting

Due to the advancements and benefits of AI technology, more and more companies are now outsourcing their bookkeeping needs. According to a survey, 82% of small businesses prefer using cloud accounting over their in-house solutions for bookkeeping purposes. Moreover, this transition has resulted in an average of 15% increase in business revenue. For small and medium businesses (SMBs), outsourcing bookkeeping to a digital accounting software provider can allow them to avoid hiring an additional workforce. It allows them to focus solely on growing the business, not filing taxes and manually entering data. Outsourcing accounting and finance operations can result in a streamlined workflow for enterprises and organizations. Since there is already too much to handle in such companies, it is wise for the leaders to outsource tedious tasks.

Suggested Reading: Expert Recommendations About Accounting Automation for Business Growth

Proactive Financial Management

Financial close can be the most worrisome time of the year for accountants. Traditionally, finance professionals tend to work long hours at the end of the fiscal year to make up for the lost time. However, the adoption of digital accounting software is reframing the entire approach to bookkeeping. Such solutions ensure accountants do not need to spend long hours on manual data entry and bank reconciliation. Furthermore, best-in-class accounting automation software have machine learning (ML) features that provide advanced insights at the click of a button. The ML algorithms identify patterns and trends in the accounting books, which allows them to produce accurate predictions and reports during the financial close.

Data Privacy and Integrity

As the world increases its reliance on technology, data breaches are gradually becoming a bigger risk than ever. The finance sector recorded around 1,829 data breaches in the previous year. Such breaches lead to identity theft and data spoofing, resulting in substantial monetary and physical damage. It becomes incredibly challenging for a company to ensure data security and privacy in the wake of such attacks. Moreover, managing an entire IT department is not suitable for most companies. Therefore, organizations around the world are outsourcing bookkeeping needs and using digital accounting software that provide advanced data security features. For instance, cloud-based solutions are widely appreciated for their security and backup characteristics. Even in a breach instance, cloud software have fail-safe plans to secure the data, minimizing the damage.

Redefine Your Accounting with RecordMe

AI and automation have been allowing accountants to get more efficient and accurate with their jobs. However, 2023 comes with significant advancements in the areas of AI and in turn, bookkeeping. Digital accounting software are now more advanced than ever, seamlessly handling tasks that previously required an entire team’s effort. However, finding automation software that fulfills your requirements can be quite challenging. With RecordMe, this decision becomes immensely easy, as it provides you with a custom solution for your accounting needs. RecordMe connects with your existing accounting software to provide quick integration and easy reconciliation, helping you save resources and time in the process.