How Automated Bookkeeping Can Help Fix The Financial Close Process?

In This Post

Poor financial data management can have a considerable and devastating impact on a business’s financial performance. A survey by Gartner revealed that poor data management and quality are responsible for an average of $15 million per year in losses. Moreover, 60% of the surveyed businesses had no idea about the high cost of poor data management because they didn’t even have a system to measure it in the first place. This is where AI finance and accounting services can be utilized to enhance the financial management of a business.

Manual Financial Management: A Liability

Manual bookkeeping and financial management are a total liability and should always be avoided. The financial close is a crucial process for a business, and any kind of error in it can lead to grave consequences. Managing physical, financial records and searching them individually for financial records is a task that takes up a lot of time and money from the business’s resources. These resources should not be spared but utilized elsewhere to nurture growth.

Bookkeeping and Accounting Automation

RecordMe provides AI-assisted bookkeeping and accounting services to automate the financial management tasks of a business. This process utilizes an AI bot for finance that uses machine learning (ML) and natural language processing (NLP) technologies to identify and extract financial information from bank and credit card statements, invoices, and other financial documents. This information is then utilized to create a cloud database to automate a business’s bookkeeping and financial processes. This database is updated regularly and provides accurate information at all times.

Suggested Reading: A Step-by-Step Guide to Ace Automated Bookkeeping

The Financial Close Process: Why It Is So Important

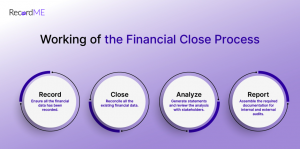

The financial close process, or month-end close, is when companies perform activities and procedures to finalize their financial records for a specific accounting period. The main objective of the financial close process is to ensure the accuracy and completeness of financial data, allowing for the preparation of reliable statements and documents that reflect the company’s financial performance and position during the period.

Improved Decision Making and Compliance

A major advantage of the financial close process is that the reports that it generates can be used to develop strategies and make informed business decisions for the next accounting period. These reports can also help businesses meet the regulatory conditions and stay compliant with the laws and regulations of the country they’re operating in.

Budget Allocation and Forecasting

The financial close process allows businesses to evaluate their performance and allocate budgets for the next phase. This can help businesses maximize efficiency and achieve their true financial potential. Financial close reports can give businesses a prediction of what their expenses and finances will look like in the next phase.

Credibility and Reputation

Conducting a financial close process can give business stakeholders and investors a clear view of the business’s performance. This maintains trust between the business and its stakeholders. Businesses need this credibility to make their mark in the market.

Financial Close Process: AI Automation

The financial close process can take much time and hinder other business processes. The financial close process is essential because businesses must have these records to facilitate audits and comply with regulations.

RecordMe’s automated bookkeeping software provides a viable solution to automate the financial close process. It eliminates manual bookkeeping and record compilation to prepare these reports. It gathers real-time data and creates these reports automatically for businesses. Financial accounting software solutions that are automated give business owners the edge of total accuracy and minimize errors. A significant amount of resources is saved that would have otherwise been wasted on creating the financial close reports. The saved resources can fund other aspects of the business that need attention.

Facilitating Audits and Assessments

A business accounting software can use the reports generated by it during the financial close process to facilitate external audits and assessments. These assessments include ICR, FDD, ESG assessments, and third-party vendor audits. These audits are done to verify the legality of the company’s assets, check their compliance with legal policies, and get an overview of the company’s financial health. These assessments and audits are necessary to improve the company’s relations with investors and other external parties. Bookkeeping and accounting automation solutions generate precise and accurate reports on demand, which help businesses deal with unexpected audits. However, having the financial close statements ready on time is the real deal. Presenting an audit with the whole set of reports can significantly increase a business’s credibility and avoid any inconvenience.

Transparency and Building Trust

By providing businesses with an efficient financial close process, an AI-assisted financial accounting software can improve a business’s relations with its customers and clients. The availability of crucial records on demand builds trust and allows customers to rely on the business. A bot for bookkeeping provides an additional layer of security for customers and the company. It incorporates advanced security protocols that help keep the customers’ financial data secure and allow them to trust the company they’re dealing with. The financial close process reports are kept secure, allowing only authorized individuals to access them. These reports can also be customized, allowing businesses to display only metrics essential to customer satisfaction. Business owners can maintain their confidentiality and gain their client’s trust simultaneously by utilizing modern AI finance and accounting solutions.

Closing Books: The Right Way

When choosing a financial accounting software, it is crucial to take its ability to manage financial close reports into consideration. This is only possible if the service you choose can track the financial records of different business departments and then order them in a readable format. RecordMe’s automated bookkeeping and accounting service provides software-generated and custom reports that can serve as financial close process reports. Moreover, it can be integrated with other accounting and communication services, which makes it the perfect bookkeeping and accounting automation solution for businesses of all sizes.

RELATED BLOGS

Search Blog

Category