Traditionally, accountants have been responsible for data entry, report generation, and other mundane tasks. Using a digital solution frees up the talent to work on high-value assignments. According to Mordor Intelligence, the global market for digital bookkeeping stood at $12.01 billion in 2020. At a Compound Annual Growth Rate (CAGR) of 8.5%, it is projected to reach $19.59 billion by 2026. Evidently, automated accounting is revolutionizing this profession since it provides far better efficiency and accuracy compared to manual counterparts. However, choosing the best online accounting software for a company can be complex. Each option includes a different set of functionalities, and most choices offer multiple pricing plans. Under such circumstances, the decision-makers should list their priorities to find the perfect solution.

Identify Requirements

The first step to simplify the search for digital bookkeeping services is identifying the company’s needs. In this phase, the business should consider the industry they operate in and its accounting workflow. Since the chosen solution will directly affect the processes, choosing one that fits closely with the original workflow is better. For this purpose, the leadership or management should communicate with relevant teams to understand their current operations. Although this step is essential, it should not be considered the final. In short, online accounting software is curated for different organizational sizes, the number of users, and the transactions they make. Researching these features can help a company narrow the search and reduce the time to automate bookkeeping processes.

Consider Features

Apart from the initial factors discussed above, a company should perform due diligence while selecting online accounting software. Companies tend to have specific operational workflows, which can get disrupted if unfamiliar software is introduced into the ecosystem. Therefore, here are some features to consider before implementing accounting automation:

1) Project Management

Businesses that provide project-based services require digital bookkeeping services with project management and time-tracking features. These capabilities allow the company to bill the client by the hour and maintain a client retainer fee. Time tracking enables the business to convert the timesheets directly into invoices. Thus, reducing the extra work for invoice generation and processing.

2) Payroll and Inventory Management

An efficient means of paying employees motivates the workforce and saves the company from wage claims. According to a survey, 45% of small businesses do not have an accountant or a bookkeeper to manage their finances. On the same note, companies often overlook inventory management, with only 43% of small businesses actively tracking it. Implementing this practice can yield better savings for the company in the long run. Nowadays, digital bookkeeping services allow clients to choose these options as well in the package.

3) Accounts Payable and Balance Sheet

Irrespective of the business, any company can significantly enhance its processes by implementing accounting automation for accounts payable and balance sheets. Accounts payable deals with money a company owes to suppliers or partners. Balance sheets provide a summary of business assets and liabilities. Automated accounting providing both features and an excellent user experience introduces efficiency in the overall process.

Check Integration Capabilities

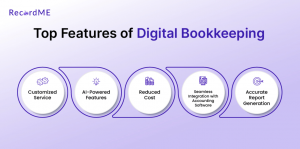

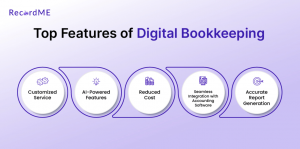

Distributed systems strain a company’s communication process, leading to significant errors and delays in project completion. Using several applications for individual processes and then reconciling the data can be hectic and confusing for the team. App integrations with accounting software and communication platforms are more practical, as they introduce cohesion and increase the team’s productivity. For instance, modern digital bookkeeping services provide seamless integration with software such as Xero and Quickbooks. Therefore, any changes made in an integrated app will also be updated in real-time on the online accounting software.

Use of Artificial Intelligence

Artificial intelligence is driving the entire industry, providing better accuracy in a cost-effective package. The market for AI-powered accounting automation stood at $2.4 billion in 2022. It is projected to grow at a CAGR of 44.9%, reaching $48 billion by 2030. Apart from the increased efficiency, one primary benefit of AI is its ability to identify underlying patterns in financial data. Using advanced machine learning models, digital bookkeeping services can swiftly extract insights from the data, helping leaders make timely decisions.

Determine the Budget

The last step to choosing digital bookkeeping services is identifying whether they fit within the budget. Apart from the outright cost of the program, leadership must decide if the online accounting software is worth the value add. One way to do this is by considering the monthly subscription price and the company’s budget. However, it is even more critical to determine the service provider’s vision for the future. Look for solutions that adapt to the market, such as AI capability in the current scenario and planning newer features.

Get Customized Accounting with RecordMe

Choosing a new software, and that too for critical work such as accounting, can be a challenging task. Typically, software change involves huge financial and monetary investments for updating the infrastructure and upskilling the employees.

RecordMe provides a better way – seamless integration with your existing accounting software and an end-to-end accounting automation solution. And that, too, in a budget-friendly manner. RecordMe takes care of your accounting so that you can focus on your business.