Most companies, especially startups and small businesses, forget the purpose of accounting. Even though maintaining books for compliance and taxes is a crucial goal, its primary aim is to ease the decision-making process by providing financial insights. Accounting plays a crucial role in helping business leaders gain insights into key metrics, assess the performance of services and products, and identify areas for strategic decision-making. Traditionally, companies have trusted accountants to maintain and audit company books. However, accounting automation solutions are rapidly taking over as they provide increased efficiency, accuracy, and usability.

In 2018, the market for accounting software stood at $11 billion. According to Fortune Business Insights, it is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.02%, reaching $20.4 billion by 2026. Due to the growing demand, multiple providers are offering their services in this space, which is why business leaders find it confusing to automate bookkeeping. Here’s how a company should choose the right online accounting software:

Fundamental Features to Consider

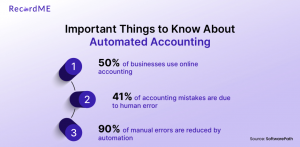

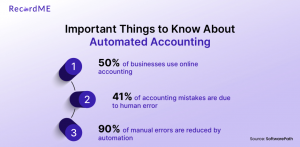

Businesses have recognized the need to shift from conventional bookkeeping methods to automated accounting. Primarily, such solutions replace the need for automatically capturing and recording data. Today’s leading online accounting services incorporate accounts payable, accounts receivable, and report generation to manage company financials. One of the foremost priorities while looking for the best accounting automation solution is to ensure the features match business requirements and needs.

Automation

Errors and typing mistakes are a staple in manual accounting processes. Accidentally missing or adding a few zeros, entering the wrong information into accounts, and transposing data are just some common accounting mistakes. The scary part is that such mistakes can cause substantial monetary and reputational losses to the business. For instance, Uber’s accounting mistake resulted in them paying $50 million to their drivers. Similarly, an accounting issue prevented Bank of America from communicating critical information about financial losses with regulators. Accounting automation uses AI-powered features to extract and collect customer data, mitigating errors due to human negligence.

Integration Capabilities

Unlike popular belief, digital bookkeeping assists accountants, not replaces them. To this end, such a solution must streamline the prevalent methods by introducing platform integration. Most companies waste precious resources and time because they maintain and record the same data on multiple platforms. Integration makes the system flexible by enabling accountants to work with CRM and communication applications without leaving the accounting portal. Any update in the interconnected apps will reflect instantly on the online accounting software, making it easy for all the teams to stay on the same page.

Auditing and Monitoring

Maintaining accurate accounts payable and accounts receivable records is necessary for digital bookkeeping. Vigilant business monitoring serves as the differentiating factor between generic and leading accounting automation solutions. Advanced solutions employ AI-based features to monitor business health and generate reports accordingly. Therefore, a company should look for online accounting services that provide balance sheets, bank reconciliation, VAT reports, and cash flow statements.

Compliance with Regional Law

Besides business goals, online accounting software must comply with regional financial laws. According to an estimate, 40% of corporations commit accounting violations, some as severe as securities fraud. In today’s landscape, businesses must comply with financial information reporting rules and tax regulations. For this purpose, a company should look for a certified accounting automation solution that continuously updates its regulatory frameworks.

Usability Factors

In addition to looking for advanced features, it’s essential to explore the basic application functionality. Here are some things to consider:

Clean User Interface

Accounting is not an easy process, and the leadership is often not skilled enough to understand its specifics. Traditionally, accountants are trusted to maintain and convey the accounting standpoint of a company to decision-makers. The current business landscape requires leaders to be in the loop to help with business decisions. For this purpose, choosing an accounting automation solution with a clean and uncluttered user interface is essential. It should make things easier for stakeholders to understand and accountants to manage.

Access Controls

Certain aspects of accounting processes have to be kept secure from unauthorized access. The best online accounting software should allow the admin to manage role-based access of employees. For instance, the admin can designate certain employees to only view reports without granting permission to edit them. Therefore, when choosing an accounting automation solution, ensure it provides selective access to limit data exposure.

Data Encryption and Updates

In addition to internal controls, online accounting services are required to provide the best encryption features to safeguard financial data. Sacrificing security in favor of technological ease can cause grave problems for a business. Choose an accounting automation solution that offers secure communication, data security, and training on security measures.

Suggested Reading: 6 Ways to Improve Your Accounting Processes With Digital Bookkeeping

Start Your Accounting Journey with RecordMe

Accounting is more than managing cash inflow and outflow. It is the process that monitors company finances, tracks accounts payable and receivable, and provides insights for driving business decisions. It can be challenging for a team to manage all these processes manually. A more viable option is to choose accounting automation to assist in-house accountants. When looking for such a solution, finding one that strikes a perfect balance between functionality and usability is crucial. RecordMe is one such automated accounting solution that provides AI-powered features in a neat package. Seamlessly integrate it with the existing system to get advanced insights accurately and efficiently.