A Comprehensive Guide to File Automation for Financial Services

In This Post

Financial institutions hold much data in bank statements, agreements, and notifications. An organisation’s performance and revenue depend on the correctness and efficiency of its file processing system. One of the finest methods is automation.

File automation streamlines complex document data production, capture, and processing with minimal human participation. By using file automation software, organisations may save time processing paperwork. In addition, the global automated file management software market is estimated to reach $10.17 billion by 2025. Thus, businesses focus on strategic tasks and boost operational efficiency.

This blog will cover file automation benefits, best practices and digital transformation.

File Automation Software – A Quick Overview

In the financial services industry, file automation streamlines development, managing, and circulating of agreements, reports, and bills. This system can retrieve accurate client data from texts by combining OCR, NLP, and machine learning techniques.

Businesses may increase regulatory compliance, decrease errors, and streamline file processing operations with automated data extraction. This was accomplished with very little to no involvement from human beings.

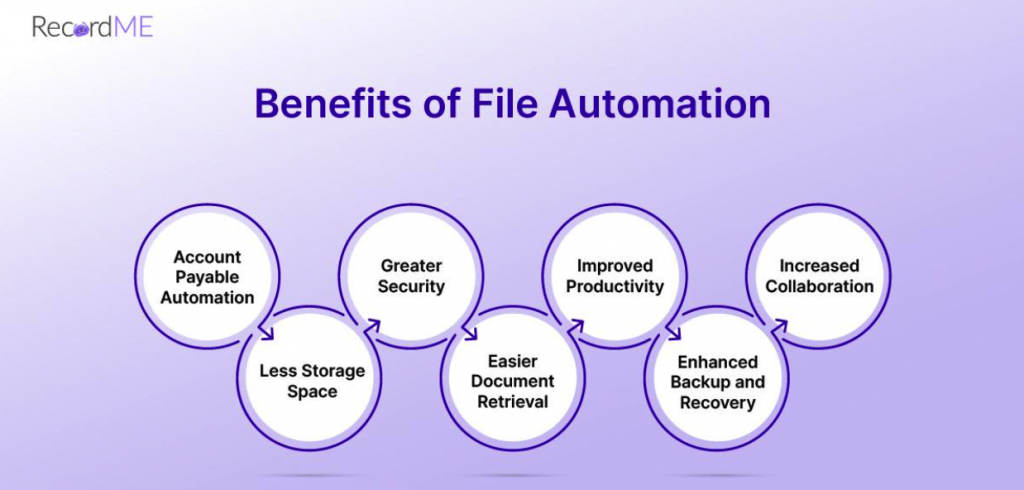

What are the Perks of File Automation System for Financial Services?

File automation is one of the most essential and beneficial components of smooth financial operations. Let’s explore them.

-

Accounts Payable Automation

Even today, many organisations use a lengthy paper trail for approval and reconciliation in accounts payable, one of the most paper-intensive tasks. Since more employees work remotely, managing the accounts payable records is a burden. For this reason, many companies are implementing advanced technologies to automate these tasks.

File automation can revolutionise accounts payable. It lets firms handle transactions, invoices, and purchase orders from any electronic device.

Automated file generation matches documents and makes them available for businesses. Automated software automatically matches purchase orders with invoices for easy reconciliation and account management.

Intelligent file automation software simplifies the accounts payable process, from confirming purchase invoices to making rapid changes before sending. Companies that prefer to do business will get more financial control and transparency with a file automation management solution.

-

Easier Document Retrieval

Document tracking, both digital and physical, takes up more time for employees. These tedious tasks require time from more important things that need to be done. However, an average of 50% of employees spend their time creating and processing documents manually.

A file automation system simplifies the research procedure rather than scanning every possible location. With the right software, file workflow automation can let firms find specific information in documents using only a word or phrase. Organisations can add tags and metadata to each document to further improve the retrieval process if the system allows it.

-

Improved Productivity

Workers can save time and effort due to an automated report generation system. The software allows employees to search, swap, and discover crucial document information in one convenient spot. Employee morale and productivity are both enhanced as a result of the handling of these issues. Building a supportive atmosphere that allows the firm’s staff to concentrate on higher-priority work is an easy way to boost productivity.

-

Enhanced Backup and Recovery

Storing visible papers poses a danger due to the prevalence of natural disasters such as floods and fires. It would take a second for the company’s most important files and data to disappear if something like this occurred. On the other hand, using an automated file management system to store documents is completely risk-free. Businesses can safeguard their data by choosing cloud-based software if they misplace the originals in an off-site backup solution.

What are the Applications of File Automation in Financial Services

File automation finds widespread application in the financial services sector. The following are some of its applications:

-

Loan Origination

Borrowers must submit their loan applications and go through a challenging verification process. The procedure calls for several documents, including firm accounting records, identity documents, income verification, credit reports, and evidence of address. Lenders face significant challenges sorting through these papers whilst classifying, analysing, and extracting the correct data.

Alternatively, by digitally recording, processing, and handling all required papers through automation, banks and NBFCs can expedite the loan origination process. They can reduce redundant data and provide more insightful analyses of income statements, investment portfolios, and client credit scores.

-

Account Opening

Financial firms may also create new customer accounts more quickly and precisely using automation. Error and time are minimised when registration forms are automatically generated by file automation software that extracts correct data.

-

Mortgage Processing

Mortgage lenders review numerous documents proving identification and income. Intelligent document processing technologies streamline the loan application process by gathering, verifying, and organising all required documentation. These solutions accurately retrieve data and check it against established standards to increase accuracy.

On these systems, lenders can also utilise data analytics to find instances of loan fraud. In addition, automated systems can complete the processing in minutes, which results in quicker response times, easier application approvals, and satisfied consumers.

-

Claims Management

Insurance companies can handle claims more quickly and effectively by electronically recording, organising, and managing every relevant file. Intelligent file automation software uses rule-based workflows to combine queries into relevant categories and assigns customers to the right agents. They perform evaluations of business profiles and find irregularities more quickly and easily.

-

Audit and Compliance Management

Electronically gathering, storing, and managing data helps financial organisations streamline audit and compliance management. However, automated software in the finance industry allows firms to eradicate file mishandling by 66% and reduce scanning mistakes by 92%. The software creates financial statements, tax forms, and regulatory report templates for audits and compliance. Therefore, organisations can customise these templates to contain client or account-specific data. Additionally, organisations may readily update them to meet regulatory changes.

The software automatically calculates and creates data fields. As a result, companies can avoid errors and offences that can lead to fines from the authorities.

How RecordMe Fits into the Puzzel

Would you like to cease managing customers’ documentation by hand? Both people and businesses can use RecordMe to automate file management procedures, decreasing labour-intensive and prone-to-error manual tasks. File automation software gives businesses a competitive edge in accurate and effective financial administration.

RecordMe is an automated accounting platform that improves financial stability and profitability for businesses by enhancing financial management security, accuracy, and efficiency. It handles issues with data entry and manual document handling. No one will stop a business from expanding, provided it correctly handles the required paperwork.

Do you still doubt how automation can help you succeed in the modern digital world? Contact us!