Since the COVID-19 pandemic, the global economy has been in freefall. In a report by the World Bank, the global economy was predicted to shrink by 5.2% in 2020. This would have been the deepest economic recession since the Second World War. Inflation and recession are intrinsically linked. The current metrics in the World Economic Outlook by the IMF indicate that the current global inflation rate is 7. Inflation creates economic uncertainty by slowing it down, which makes it difficult for businesses to function.

Operating in a troubled economy can be very difficult for businesses. The biggest challenge that it presents is managing finances. It can be challenging for businesses to manage and conserve their resources in a troubled economy, as it limits their ability to manage and predict. This is where the need to automate bookkeeping and financial processes emerges.

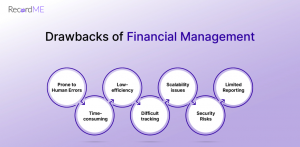

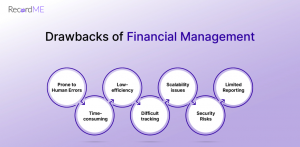

Manual Financial Management: Drawbacks

Manual financial management can be a hassle, especially for businesses in an uncertain economic system. Keeping up with the financial conditions of the economy and altering the records accordingly is an inconvenience, as it consumes a lot of time and requires more physical labor. Manual financial management also impacts budgeting and forecasting directly because, as economic conditions change, the need to alter budgets and financial plans also increases. There is also a big chance of errors in manual financial management, which can have a significant impact on the business’s finances.

Automated Financial Management

AI bookkeeping solutions such as RecordMe provide automated bookkeeping and financial management services to businesses. An AI-integrated finance bot is utilized in this process. These software solutions use their machine-learning capabilities to identify and extract data from the financial documents of the company to create a specific database for them. The bot then refers to this database whenever there is a need for it to fill the required fields with accurate data automatically. This data can further automate other financial processes, such as creating invoices and reports.

Suggested Reading: Avoid these Financial Reporting Mistakes with Digital Bookkeeping

Automated Bookkeeping: Safeguarding Businesses

AI accounting and bookkeeping services provide a full-scale financial management solution for businesses. These software solutions can help businesses safeguard their finances in a troubled economy.

1. Cost and Time-Efficient

During tough economic times, businesses continually seek ways to save money and time. Small businesses, especially those that can not afford physical staff for this purpose, can utilize these AI bookkeeping services and avail themselves of efficient financial management. The resources saved by these solutions can free business owners from the hassle of managing finances and help them focus on growing their businesses.

2. Cash-Flow Management

Accurate and smooth cash-flow management becomes necessary for businesses when there is economic uncertainty. AI bookkeeping solutions can help businesses navigate the challenges they face in managing their cash flow. These software solutions can identify future cash-flow problems early on by analyzing the business’s current financial performance and economic conditions. Reports on these conditions are generated, which helps companies stay a step ahead of any economic turns that may come.

3. Accurate and Real-Time Insights

Bookkeeping and accounting automation software provide real-time insights into a business’s financial performance that cannot be accessed in manual financial management unless formulated. These real-time insights keep business owners informed of their current financial condition, which can then be compared with the economic condition of the country or region they’re conducting business in. They can take decisions accordingly and preserve their business after any economic problem.

4. Legal Compliance

When an economy is experiencing problems or downturns, the government may make unpredictable changes to its policies and regulations. Urgent compliance with them is necessary for businesses; otherwise, they’re charged with legal charges and hefty fines. AI bookkeeping solutions help companies stay compliant with these regulations and policies. These software solutions stay up-to-date on the changes in the regulatory environment and generate the necessary reports to make companies comply with them.

5. Flexibility

Automated Bookkeeping and AI accounting solutions are highly flexible and scalable. They can scale up to huge amounts of data in seconds, which goes unnoticed. They can be scaled and adjusted according to changing economic conditions. These software solutions can make changes that favor the business and help improve its efficiency. In case of an economic downfall, these software solutions adjust according to the business’s needs and assist them in navigating through the downfall.

Automated Bookkeeping: Improved Relationships

AI bookkeeping solutions can help improve a company’s relations with its customers, clients, and employees. These bookkeeping software solutions can be integrated with CRM and Payroll services, which allow companies to automate these tasks. By automating payrolls, businesses can save a lot of time, and errors in payrolls can be avoided, building trust between the company and its employees. In case of an economic downfall, the customers of a company count on them, and in the same way, these companies can rely on AI bookkeeping services to manage their finances. To provide their customers with the best service possible, companies need to lessen their burden and focus on their services. An AI accounting software does precisely that and frees a company of its financial management burden in the event of an economic downfall.

The Bottom Line

RecordMe’s automated bookkeeping software provides businesses a smooth financial voyage during tough economic times. During an economic crisis, the main goal of every business is to save resources and limit their expenditures. Keeping track of huge and uncertain figures is not possible for humans, which is why it is best to automate the bookkeeping and financial processes. Accuracy and reliability are the best partners a business can have when the economy is troubled. By adopting these services, businesses gain real-time financial insights, optimize cash flow, ensure compliance, and manage resources wisely, laying a solid foundation for continuous growth and prosperity even when the odds are not in their favor.